About PPK TRUST LTD

Your Trusted Financial Partner

Experience and Expertise You Can Rely On

PPK TRUST LTD is a financial institution with a focus on providing personalized, trustworthy, and efficient financial solutions. We have established ourselves as a trusted partner for individuals, families, and businesses looking to grow and protect their wealth.

The glue that holds business relationships together, that is trust, and this trust is purely based on integrity.

Peter Pius Kritzer, Founder & CEO

What Is a Trust Fund and How Does It Work?

A trust fund is an tool that is a legal entity that holds property or assets for a person or organization. Trust funds can hold a variety of assets, such as money, real property, stocks, bonds, a business, or a combination of many different types of properties or assets.

Three parties are required in order to establish a trust fund: the grantor, the beneficiary, and the trustee. Trust funds are managed by the trustee who must act for the benefit of the grantor and beneficiary.

Trust funds can take many forms and can be established under different stipulations. They offer certain tax benefits as well as financial protections and support for those involved.

Key Takeaways

- A trust fund is designed to hold and manage assets on someone else's behalf, with the help of a neutral third party.

- Trust funds include a grantor, beneficiary, and trustee.

- The grantor of a trust fund can set terms for the way assets are to be held, gathered, or distributed.

- The trustee manages the fund's assets and executes its directives, while the beneficiary receives the assets or other benefits from the fund.

- Trust funds can be revocable and irrevocable, and there are several variations that exist for specific purposes.

For what you can use a Trust

Trust funds provide certain benefits and protections for those who create them and to their beneficiaries. For instance:

- Some types can keep assets held away from any creditors in the event they decide to pursue the grantor for unpaid debts.

- They avoid the need to go through probate, which is the process of analyzing and distributing assets after someone dies without leaving any instructions behind.

- Some trust funds can reduce the amount of estate and inheritance taxes owed after the grantor dies, after which the assets are distributed to the beneficiary(s).

- Trusts can be named the beneficiary of an individual retirement account (IRA) but will be subject to accelerated withdrawal requirements and shortcircuit spousal inheritance provisions.

Types of Trust Funds

Revocable and irrevocable trust arrangements can be further classified into several types of trust funds. These types often have different rules and stipulations depending on the assets involved and, more importantly, the beneficiary. A tax or a trust attorney may be your best resource for understanding the intricacies of each of these vehicles. Keep in mind that this isn't an exhaustive list.

- Asset Protection: This fund protects a person's assets from their creditors' future claims.

- Blind: This fund tries to remove any hint of conflict of interest. As such, the trust fund's grantor and beneficiary have no knowledge of the holdings or how they are managed. It does, however, give control to the trustee.

- Charitable: A charitable trust fund benefits a particular charity or the general public.

- Generation-Skipping: This one contains tax benefits when the beneficiary is one of the grantor’s grandchildren, or anyone at least 37½ years younger than the grantor.

- Grantor Retained Annuity: Establishing this type of fund allows the grantor to transfer any appreciation of assets to any beneficiaries to minimize estate taxes.

- Individual Retirement Account: Trustees control IRA distributions rather than the beneficiaries.

- Land: This allows for the management of property, such as land, a home, or another type of real estate.

- Marital This is funded at one spouse's death and is eligible for the unlimited marital deduction.

- Medicaid: Designed to allow individuals to set aside assets as gifts to their beneficiaries, this allows the grantor to qualify for long-term care under Medicaid.

- Qualified Personal Residence: An individual can move their personal residence from their estate to this type of fund in order to reduce the amount of gift tax incurred.

- Qualified Terminable Interest Property: This one benefits a surviving spouse but allows the grantor to make decisions after the surviving spouse’s passing.

- Special Needs: People who receive government benefits are the beneficiaries so as not to disqualify the beneficiary from such government benefits.

- Spendthrift: Beneficiaries don't have direct access to the named assets, which means they can't sell, spend, or give away the assets without specific stipulations.

- Testamentary: This fund leaves assets to a beneficiary with specific instructions following the grantor’s passing.

How Do Trust Funds Work?

Trust funds are legal entities that provide financial, tax, and legal protections for individuals. They require a grantor, who sets it up, one or more beneficiaries, who receive the assets when the grantor dies, and the trustee, who manages it and distributes the assets at a later date.

Trust funds are designed to carry out the wishes of the grantor. This means that the trustee is in charge of managing the assets while they are still alive. After their passing, the trustee can pass on the assets to the beneficiary(s) as per the grantor's instructions, whether that's through a regular income stream or a lump sum payment.

Ready to Secure Your Financial Future?

Contact Us Today

If you are ready to take control of your financial future and receive personalized financial solutions, we are here to help. Contact our team today to schedule a consultation.

PPK TRUST LTD pledges that the wishes of the founders of the trust will be faithfully executed in all respects.

PPK TRUST LTD works diligently and in close cooperation with founders, beneficiaries, trust protectors, lawyers, advisors and managers to attain this goal.

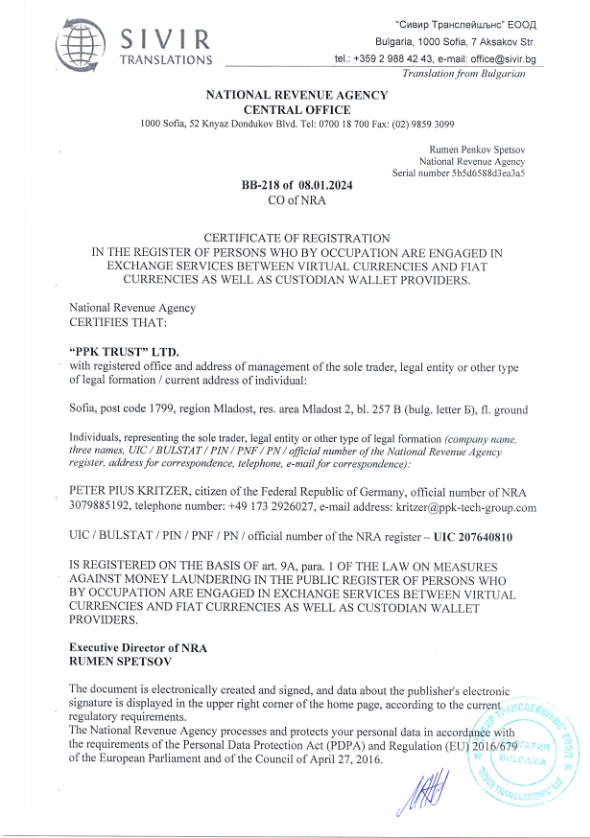

PPK TRUST LTD IS REGISTERD AND LICENSED AT NATIONAL REVENUE AGENCY BULGARIA

UIC/BULSTAT/EGN/LNH/LN/service number 207640810

PPK TRUST LTD 2023©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.